Prior to the COVID-19 pandemic, second-hand was called the fastest growing segment of the fashion industry. By 2030, it should surpass the mass market, hundreds of millions of dollars are invested in it; it is worn by Kanye West and Kylie Jenner, and even fashion houses have to be considered platforms selling worn clothes.

Now, with the onset of the global crisis, the second-hand has every chance to make an even bigger leap. Let’s check the DTF Magazine opinion about the role of the secondary market in world fashion and understand what will happen to it after the coronavirus.

How in fashion second-hand was treated before and who was the first to use it

Back in the early nineties, second-hand was considered the lot of poor people and was almost not associated with anything fashionable. Things were much better with vintage: the founders of vintage stores searched for second-hand clothes from old collections, and then offered their customers a better selection.

That’s how London’s Steinberg & Tolkien and Rellik, Paris’s Didier Ludot, Milan’s Vintage Delirium and other vintage stores appeared. There, the clothes found at flea markets and collectors were put in order, and then put up for sale. John Galliano, Marc Jacobs and other designers became customers of such stores, looking for both things and inspiration for future collections in such stores.

In Japan, vintage was considered a cult thing: “The Japanese significantly influenced the popularization of vintage. They were the first to collect vintage Levi’s and vintage American T-shirts, while Americans just threw them away, ” said Jeff Staple, designer and founder of Staple Design, in an interview with DTF Magazine.

British designer Vivienne Westwood sold old clothes at the beginning of her career. Students at Central Saint Martins College went to local flea markets searching for things and fabrics, which were then sewn into clothing for student collections. Raf Simons, visiting flea markets in Vienna, was inspired by teenagers from Ukraine and Romania, who bought things and wore them in several layers. But these were only a few examples.

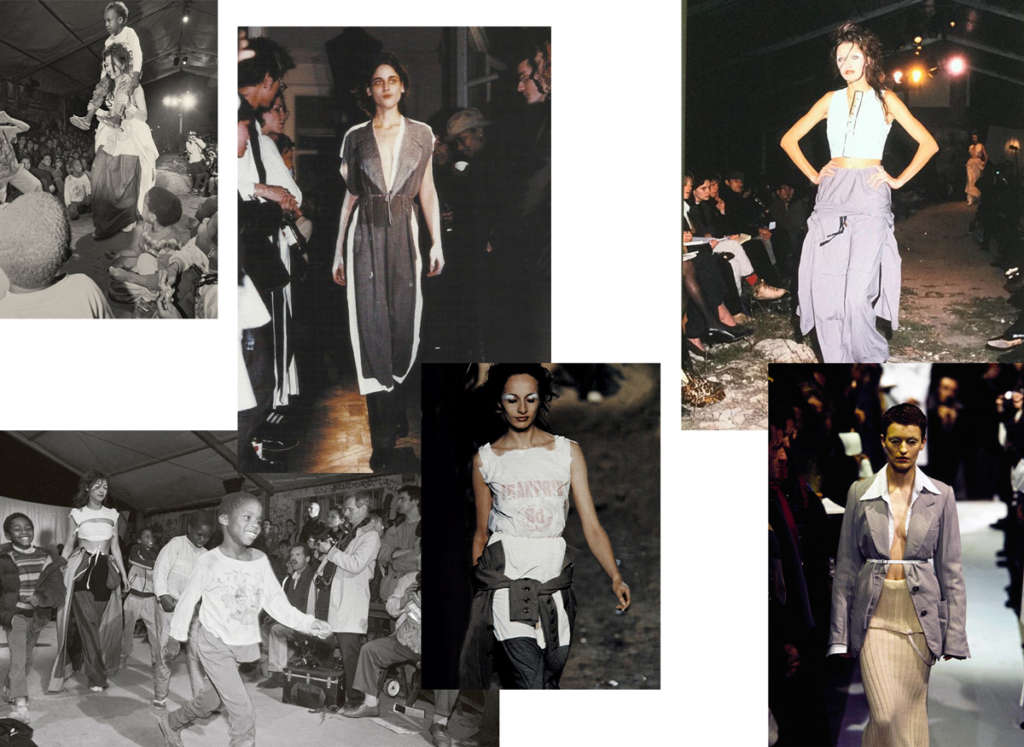

Belgian designer Martin Margela was one of the first to bring second-hand fashion into high fashion. However, in the case of Margela, the decision to use worn things and old fabrics were rather forced: in the first years after the founding of the brand, he did not have the money to purchase the necessary materials. As a result, Martin made upcycling a feature of his brand. Margela and his team looked for clothes at flea markets and second-hand shops (they also found props for shows) and sewed them into new things.

With the development of the Internet, the secondary clothing market has moved online. Fans of vintage and archival items gathered and traded on forums. For less sophisticated buyers, an online eBay auction was launched in 1995. There was no emphasis on things on eBay, but you could find a vintage Chanel bag and buy worn-out Nike sneakers cheaper. With the launch of Facebook and Reddit in the first half of the 2000s, sales began on these platforms, but there was no talk of mass popularity.

How the second-hand market has changed over the last ten years

A new stage came in the 2010s. In 2009, the online platforms thredUP and Vestiaire Collective were launched. Two years later – Depop, The RealReal, and Poshmark. Two years later, Grailed was found, where in addition to luxury brands, streetwear and rare releases such as Adidas and Rafa Simons sneakers are resold. Something that was considered the fate of hipsters in the previous decade suddenly became popular and attracted investment.

Last year, The RealReal became the first second-hand company to list shares on the New York Stock Exchange. The RealReal sold $ 300 million worth of shares. On the first day of trading, they rose by 50%, and the company’s capitalization exceeded two billion dollars. The example of The RealReal showed that investors believe in the future of second-hand.

The company’s founder, Julie Wainwright, said she decided to create the platform after meeting the owner of a boutique in San Francisco, who opened a consignment shop and sold used luxury to wealthy customers. Now, in addition to the online platform, the company has stores in New York and Los Angeles. In 2018, The RealReal’s sales exceeded $ 700 million, and revenue reached $ 207 million.

The RealReal has won the trust of customers through an authentication system. The company hires clothing and accessories specialists to verify the authenticity of each item so that in 2018, about 80% of purchases on the platform fell on its regular customers.

The case of The RealReal is not an isolated one. Last year, the British startup Depop attracted more than $ 60 million in investments, the thredUP platform – 175 million, and Vestiaire Collective – 45 million to develop international business. Retailer Farfetch launched special sections for worn clothing; snicker retailer Foot Locker has invested 100 million in the reseller platform GOAT, and retailer Neiman Marcus to drank shares of luxury reseller Fashionphile.

Why second-hand suddenly became so popular

According to a report by thredUP and GlobalData analysts, in the US in 2018, sales in the secondary market amounted to $24 billion, while the mass market reached 35 billion. In the same year, the share of second-hand was 7% of the total fashion market, but its performance grew four times faster than the main market. The report said that in five years, the turnover of second-hand cars would double and exceed the mark of 50 billion dollars, and in 10 years – it will reach 64 billion. During the same period, the mass market was forecast to grow to 44 billion.

BCG consulting firm also notes the potential of the secondary market. She estimates that by 2021 it will grow to $ 36 billion with an average annual growth of 12%. For the same period, luxury is projected to grow by only 3%.

“Instagram, the abandonment of property, the growing importance of responsible production and consumption have become factors that have finally changed the consumer habits of Generation Z and millennials. All this has prepared the perfect ground for the growth of the resale market,” said Max Bittner, CEO of Vestiaire Collective.

Analysts identify several critical reasons for the popularity of second-hand:

Launch of online stores

Second-hand fans no longer have to go shopping – Grailed, Depop, The RealReal, and other platforms allow you to buy things without leaving home. In addition, everyone can choose a convenient site: the interfaces of Depop and Poshmark are similar to the Instagram application, which is why they are popular among young people, and shopping on The RealReal is not inferior to luxury retailers.

Reluctance to buy luxury items at full price

Over the past ten years, analysts have noted the rejuvenation of the audience of luxury brands, but its acquaintance with luxury is increasingly occurring in the secondary market. According to fashion critic Yevgeny Rabkin, unreasonably high prices for things are among the critical factors in the growing popularity of the resale.

According to a GlobalData study, in 2018, 64% of women bought or agreed to purchase worn clothes, while in 2017, this figure reached 44%.

The desire to look unique and the trend for vintage

This is typical for teenagers who prefer to find in local second-hand or Depop shopping at H&M, as well as for stars like Kylie Jenner or Kim Kardashian. They work with vintage buyers offering archival Dior, Louis Vuitton, and other brands. Kanye West also has such a buyer: in an interview with Business of Fashion, Greg Ross recalls how in 2018, he flew to a second-hand warehouse in Seattle and bought an old army uniform for a thousand dollars. These things are included in the mood board of the Yeezy collection.

(A mood board is a type of visual presentation or “collage” consisting of images, text, and samples of objects in a composition. It can be based on a set topic or can be any material chosen at random. A mood board can be used to convey a general idea or feeling about a particular subject. They may be physical or digital and can be effective presentation tools).

Collector Patrick Matamoros specializes in old merch bands and musicians like My Bloody Valentine, Guns & Roses, or Lorin Hill. His clients include Kanye, Rihanna, Frank Ocean, Young Thug, Lil Uzi Vert, and dozens of other artists who buy things from Patrick, despite the abrasions and holes. His findings were used in collaboration with Fear of God: in 2016, the brand and collector released a line of 65 vintage T-shirts.

It’s no longer a shame to buy worn clothes: A $ AP Nast confesses his love of second-hand clothes, Travis Scott wears vintage Louis Vuitton and Céline, and Drake in the Toosie Slide track is filmed in an archive bomber from the 2001 Raf Simons collection, which can be found only that collectors (and not less than 20 thousand dollars).

In the report for 2019, the search platform Lyst identifies the category of vintage as one of the fastest-growing trends: over the past year, the number of queries increased by 62%. And in a joint report by McKinsey and Business of Fashion, race, and vintage are among the top ten themes of the year.

Off-White founder Virgil Ablo said the same thing at the end of last year: “One day we will reach a state where we will express our style through vintage – because there are so many cool clothes in vintage stores that you just need to start wearing. I guess that fashion will go away from buying new things, and we will begin turning to the archives.”

The growing relevance of the environmental agenda

In 2016, Greenpeace claimed that more than 80 billion clothing items are produced worldwide each year, a figure that is 400% higher than 20 years ago. Analysts believe that at this rate, by 2030, consumption will increase by 60%, and existing things will be able to cover the two planets.

According to Eugene Rabkin, most brands sell only half of the items at the usual price – the rest goes on sale and outlets. Until recently, some brands simply destroyed unsold goods to maintain their exclusivity.

In 2018, it turned out that the French brand Burberry burned things worth about $ 40 million. Buyers boycotted the brand and only then made Burberry promise to stop destroying goods. Nike and Louis Vuitton used to be used for recycling. However, in February, such cases still occur: a resident of Colorado saw hundreds of Victoria’s Secret bras in the trash, which the brand’s employees threw away after the store closed.

Proponents of second-hand believe that buying used items will help improve the environmental situation and reduce the carbon footprint. Such beliefs are most often observed in Generation Z, for whom second-hand is the answer to fast fashion.

How brands relate to second-hand and its turnover

The RealReal was not only the first to go public but also began to work with brands. Stella McCartney noticed the eco-positioning of the platform: in 2017, the Stella McCartney brand became a partner of the platform and gave a voucher for $100 for each sale on the site. Last year, Burberry joined The RealReal: for selling items on the platform, the brand offers personal shopping services in stores in the United States.

In 2019, the British retailer Selfridges merged with the Vestiaire Collective platform and opened the first permanent second-hand luxury store, and Ralph Lauren with the Depop marketplace launched the Re / Sourced program, in which vintage items were sold in a pop-up store at the flagship store Ralph Lauren in London. And in May 2020, one of the largest American chains Walmart announced a partnership with thredUP and will sell used clothes and shoes in its stores.

However, not everyone is happy with the popularity of the secondary market. In November 2018, Chanel filed a lawsuit against The RealReal, accusing the company of selling counterfeits and deceiving buyers.

“The only way to make sure you’re buying a real Chanel is to buy the item directly from Chanel or our authorized reseller,” the brand said in a statement.

“Brands do not have to accept us, because we sell things from consumer to consumer. Most brands understand that a strong secondary market contributes to a strong primary market,” said Chanel, founder of The RealReal.

Their dispute is still pending: in late March this year, the court invalidated The RealReal’s allegations of violating Chanel’s rights to sell things and unfair competition, but continued to consider allegations of selling fakes. However, last year The RealReal was indeed caught selling counterfeits. As it turned out, some of the employees who conducted the authentication were incompetent and could not determine their authenticity. The company then apologized and promised to improve authentication standards.

“This controversy underscores the tension between recycled platforms and fashion houses that have built businesses on the concept of exclusivity,” said marketing professor Barbara Kahn. “When things of expensive brands are not worn by the elite, it threatens to undermine the value of these brands for those people who can really afford luxury clothing.”

However, the apparent threat from platforms offering affordable luxury does not prevent brands and retailers from launching their own second-hand initiatives.

Outdoor brands Patagonia and Arc`teryx have in the past started accepting worn clothes and reselling them on their websites. In May 2019, Farfetch launched a test program Second Life for the resale of designer bags, and also allowed to sell second-hand and vintage on the main site. The test platform for second-hand sales was launched by the Nordstrom department store, and retailer Browns opened the One Vintage section, which sells items made on the principle of upcycling.

The mass market is not left out either. Last year, H&M launched test rental and second-hand sections (although only in Sweden) for the H&M and & Other Stories brands in a test mode, and Guess and Urban Outfitters sell worn items on their platforms.

Another noticeable trend is the creation of full-fledged collections of worn things. Previously, upcycling was practiced mainly by small niche brands, but now it has become a symbol of environmental friendliness and new luxury: second-hand collections are created by Marine Serre, denim brand from Ukraine KSENIA SCHNAIDER, Converse, Carhartt WIP and returned to the origins of Maison Margiela under the leadership of John Galliano and his team are looking for vintage items created in the days of Martin Margela, and create new ones from them as part of a special line Reclica.

“If I managed a brand and saw that the recycling market was growing 21 times faster than the general fashion market, I would immediately ask myself, ‘How do I break the bank?,'” thinks retail consultant Doug Stevens. Based on such forecasts, brands need to see in the secondary market not a threat but an opportunity.

How the COVID-19 pandemic will affect the secondary market

The ensuing pandemic disrupted the fashion cycle: brands spoke of falling sales, retailers of supply disruptions, factories stopped receiving orders and closed, collections were delayed, and Fashion Weeks were canceled or moved online. Retailers also suffered from COVID-19 – in March, 2020 they reported a record drop in sales, and in April, 2020 Saks Fifth Avenue and Neiman Marcus declared bankruptcy.

During a pandemic, the position of the secondary market looks more c stable, and the crisis may play into his hands. At least you don’t have to sew collections, wait for deliveries and open stores – the turnover here is constant. Some brands have already turned to second-hand sales platforms to sell unsold items. This was reported by The RealReal, Poshmark, and Depop (though without naming specific names).

While in quarantine, people are not only looking for ways to do profitable online shopping but have also started selling more things. Some – because of the opportunity to get rid of unnecessary clothes, and some – after losing their jobs due to the crisis. Reuters writes that this trend is now observed in China, and The Guardian notes the growing popularity of second-hand among the British.

However, soon, the secondary market may face massive discounts introduced by brands to bring back buyers. “When it’s all over, the resale will lose some of its benefits,” said Chris Ventry, president of SSA & Company’s business solutions firm. “When everything is sold at a discount, buyers are likely to go to retail first.”

But a recent report by the analytical company Bain & Company predicts the return of the luxury goods market to 2019 not earlier than in 2022. In addition, designers and specialized publications themselves are massively calling for “slowing down” the pace of fashion. Perhaps this is the ground for the next second-hand jerk.